What if you were approached by a stranger who claimed to be a business mogul, and he told you that he could offer you an opportunity to invest just a little bit of your money and double or triple it within weeks or even days? At first, you might be skeptical, but what if he did just that, and then introduced you to real people who claimed that he had done the same for them? At that point, you might be willing to invest even more. Suddenly, after you hand over all your money, you realize you’ve become the victim of a Ponzi scheme. So if you don’t want to be swindled and want to see real gains, you can try games like 겜블시티.

What if you were approached by a stranger who claimed to be a business mogul, and he told you that he could offer you an opportunity to invest just a little bit of your money and double or triple it within weeks or even days? At first, you might be skeptical, but what if he did just that, and then introduced you to real people who claimed that he had done the same for them? At that point, you might be willing to invest even more. Suddenly, after you hand over all your money, you realize you’ve become the victim of a Ponzi scheme. So if you don’t want to be swindled and want to see real gains, you can try games like 겜블시티.

What is a Ponzi Scheme?

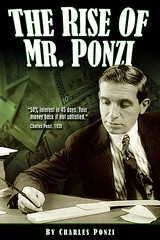

Named after Charles Ponzi, a Ponzi scheme is one that bilks money from naive investors by promising amazing returns on investments that don’t exist. A classic example of a Ponzi scheme is where the originator of the scheme and his or her initial investors are the only people who make money, while everyone else loses theirs. Ponzi schemes are an example of a form of securities fraud which encourages investors to make decisions on the basis of false information and securities fraud attorneys strongly advise against inside trading of any kind.

How Does a Ponzi Scheme Work?

Typically, a Ponzi scheme will require people to give money to the originator that is supposed to be invested. Often, the originator of the scheme will be secretive or vague about how and where the money is coming from and will be invested. What happens next is that the originator of the scheme will take money from later investors and pay himself or herself and a few initial investors… at first. This is done to show later investors that the investments are working. From there, the scheme generates more excitement and more investors, and their monies are used to perpetuate the cycle. Eventually, because greed knows no bounds, the scheme becomes too large and ultimately collapses upon itself, but by that time, the originator of the scheme, if smart, will have disappeared with everyone’s money.

Infamous Ponzi Schemes

In the past few years, one of the biggest Ponzi schemes in United States history was uncovered after Bernie Madoff was discovered to have bilked over $18 billion from investors. Madoff essentially offered phony investments and returns reports to investors, all while pocketing their investments. As a result of his actions, Bernie Madoff pleaded guilty to various felony charges and was sentenced to 150 years in prison. Another recent and famous example of a Ponzi scheme involved Allen Stanford, of the Stanford Financial Group. Stanford, like Madoff, created fake account statements and promised investment returns that consistently beat the market, ultimately leading to investors being defrauded to the tune of $7 billion. Stanford was sentenced to 110 years in federal prison for his crimes.

How Ponzi Schemes Hurt the Little Guy

Because Ponzi schemes are designed to only pay people at the top, they ultimately end up hurting the little guy because everything rolls downhill. Investors who get in on the ground floor often receive returns on investments in order to be used as examples of how the system works, thus fooling later investors into believing that they too will receive the same. Unfortunately, by the time most investors figure out what has happened, the originator of the scheme has skipped town, only to run their con again somewhere else. The moral to the story is: do your homework; dig deeper than the surface before investing large sums of money.

If you feel like you’ve been the victim of a Ponzi scheme, or if you have been approached by someone promising what sounds like a Ponzi scheme, consider reporting it to the authorities. This not only includes speaking with your local police department, but you need to also contact the Securities and Exchange Commission to notify them of the potential for a Ponzi scheme. Finally, always remember, if a deal sounds too good to be true, it probably is.

Having been the victim of money grabbing schemes on a much smaller level, Heather Shipp is a huge proponent of anything that is anti-scam. Page Perry employs securities fraud attorneys who specialize in protecting investor rights. The Atlanta based law firm represents clients harmed in securities and financial transactions. With more than 170 years of collective experience, the team Page Perry has assembled handles more than 12 practice areas.

Photo Credit: MarkGregory007